OFL

Updated: 30 June 2014

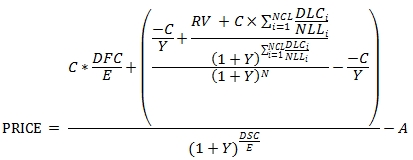

Use OFL to calculate the price or yield of a bond with an odd first period, an odd last period, and a par value of 100. The OFL formula for a bond with an odd short first coupon is:

Where

|

A

|

=

|

C * accrued days / E

|

|

C

|

=

|

100 * coupon rate / frequency

|

|

DFC

|

=

|

the number of days from the issue date to the first coupon date

|

|

DLCi

|

=

|

the number of days from the previous coupon date to the lesser of the next coupon date and the maturity date in the ith last quasi-coupon period

|

|

DSC

|

=

|

number of days from settlement to coupon

|

|

E

|

=

|

the normal length of the first quasi-coupon period

|

|

N

|

=

|

the number of coupons between the first coupon date and the last coupon date

|

|

NCL

|

=

|

the number of quasi-coupons from the last coupon date to the quasi-maturity date

|

|

NLLi

|

=

|

the normal length in days of the full ith quasi-coupon period in the odd last period

|

|

RV

|

=

|

redemption value

|

|

Y

|

=

|

yield / frequency

|

The OFL formula for a bond with an odd long first coupon is:

Where

|

Ai

|

=

|

number of accrued days for the ith quasi-coupon period

|

|

C

|

=

|

100 * coupon rate / frequency

|

|

DFCi

|

=

|

number of days from the issue date to the first quasi-coupon date or the number of days in the quasi-coupon period

|

|

DLCi

|

=

|

the number of days from the previous coupon date to the lesser of the next coupon date and the maturity date in the ith last quasi-coupon period

|

|

DSC

|

=

|

number of days from settlement date to the next quasi-coupon date or first coupon date.

|

|

E

|

=

|

number of days in the quasi-coupon period in which settlement occurs

|

|

N

|

=

|

the number of coupons between the first coupon date and the maturity date

|

|

NCF

|

=

|

number of quasi-coupon periods that fit in the odd first period

|

|

NCL

|

=

|

the number of quasi-coupons from the last coupon date to the quasi-maturity date

|

|

NLFi

|

=

|

normal length in days of the full ith quasi-coupon period within the odd period.

|

|

NLLi

|

=

|

the normal length in days of the full ith quasi-coupon period in the odd last period

|

|

Nqf

|

=

|

the number of whole quasi-coupon periods between the settlement date and the first coupon.

|

|

RV

|

=

|

redemption value

|

|

Y

|

=

|

yield / frequency

|

The OFL function allows you to pass value for DFC1, DFC2, A1, A2, NLF1, NLF2, DLC1, DLC2, NLL1, NLL2, NCL, NCF, N, Nqf, DSC, E, and RV directly into the equation and automatically calculates Y and C. OFL does not support bonds with more than 2 quasi-coupons in either the first or last coupon periods.

Syntax

SELECT [wctFinancial].[wct].[OFL](

<@Rate, float,>

,<@Yield, float,>

,<@Price, float,>

,<@RV, float,>

,<@Freq, int,>

,<@A1, float,>

,<@A2, float,>

,<@DSC, float,>

,<@E, float,>

,<@N, int,>

,<@ShortFirst, bit,>

,<@ShortLast, bit,>

,<@DLC1, float,>

,<@DLC2, float,>

,<@NLL1, float,>

,<@NLL2, float,>

,<@DFC1, float,>

,<@DFC2, float,>

,<@NLF1, float,>

,<@NLF2, float,>

,<@Nqf, int,>)

Arguments

@Rate

the bond's annual coupon rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Yield

the bond’s annual yield. @Yield is an expression of type float or of a type that can be implicitly converted to float.

@Price

the price of the bond. @Price is an expression of type float or of a type that can be implicitly converted to float.

@RV

the bond’s redemption value per 100 face value. @RV is an expression of type float or of a type that can be implicitly converted to float.

@Freq

the number of coupon payments per year. For annual payments, @Freq = 1; for semi-annual, @Freq = 2; for quarterly, @Freq = 4; for bimonthly @Freq = 6; for monthly @Freq = 12. @Freq is an expression of type float or of a type that can be implicitly converted to float.

@A1

the number of accrued days in the first quasi-coupon period of the odd first period. If @ShortFirst = 'True' or @ShortFirst = 'False' and @Nqf = 1 then this is the number of accrued days for the bond. If @ShortFirst = 'False' and @Nqf = 0 then this should be the same as the value entered in @DFC1. @A1 is an expression of type float or of a type that can be implicitly converted to float.

@A2

the number of accrued days in second quasi-coupon period in the odd first period. If @ShortFirst = 'True' then this should be NULL. @A2 is an expression of type float or of a type that can be implicitly converted to float.

@DSC

the days from settlement to next coupon date (when @N > 1) or the days from settlement to redemption (when @N = 1). @DSC is an expression of type float or of a type that can be implicitly converted to float.

@E

the number of days in the settlement period. @E is an expression of type float or of a type that can be implicitly converted to float.

@N

the number of coupons from the first coupon date to the last coupon date. @N is an expression of type int or of a type that can be implicitly converted to int.

@ShortFirst

a bit value which identifies the bond as having a short first coupon period ('True') or a long first coupon period ('False'). @ShortFirst is an expression of type bit or of a type that can be implicitly converted to bit.

@ShortLast

a bit value which identifies the bond as having a short last coupon period ('True') or a long last coupon period ('False'). @ShortLast is an expression of type bit or of a type that can be implicitly converted to bit.

@DLC1

the number of days from the last coupon date to the maturity date (when @ShortLast = 'True') or the number of days from the last coupon date to the quasi-coupon date (when @ShortLast = 'False'). @DLC1 is an expression of type float or of a type that can be implicitly converted to float.

@DLC2

the number of days from the quasi-coupon date to the maturity date. If @ShortLast = 'True' then @DLC2 should be NULL. @DLC2 is an expression of type float or of a type that can be implicitly converted to float.

@NLL1

the normal length of the first quasi-coupon period. @NLL1 is an expression of type float or of a type that can be implicitly converted to float.

@NLL2

the normal length of the second quasi-coupon period. If @ShortFirst = 'True' then @NLL2 should be NULL. @NLL2 is an expression of type float or of a type that can be implicitly converted to float.

@DFC1

the number of days from the issue date to the quasi-coupon date (when @ShortFirst = 'False') or the number of days from the issue date to the first coupon date (when @ShortFirst = 'True'). @DFC1 is an expression of type float or of a type that can be implicitly converted to float.

@DFC2

the number of days from in the second quasi-coupon period. If @ShortFirst = 'True' then @DFC2 should be NULL. @DFC2 is an expression of type float or of a type that can be implicitly converted to float.

@NLF1

the normal length of the first quasi-coupon period. @NLF1 is an expression of type float or of a type that can be implicitly converted to float.

@NLF2

the normal length of the second quasi-coupon period. If @ShortFirst = 'True' then @NLF2 should be NULL. @NLF2 is an expression of type float or of a type that can be implicitly converted to float.

@Nqf

the number of whole coupon periods between the settlement date and the first coupon date. If @ShortFirst = 'True' then @Nqf should be 0. @Nqf is an expression of type int or of a type that can be implicitly converted to int.

Return Type

float

Remarks

· If @Rate is NULL then @Rate = 0.

· If @RV is NULL then @RV = 100.

· If @Freq is NULL then @Freq = 2.

· If @E is NULL then @E = 180.

· If @DSC is NULL then @DSC = 0.

· If @N is NULL then @N = 0.

· If @ShortFirst is NULL then @ShortFirst = 'True'.

· If @ShortLast is NULL then @ShortFirst = 'True'.

· If @A1 is NULL then @A1 = 0.

· If @A2 is NULL then @A1 = 0.

· If @DLC1 is NULL then @DLC1 = 0

· If @DLC2 is NULL then @DLC2 = 0

· If @DFC1 is NULL then @DFC1 = 0.

· If @NLL1 is NULL then @NLL1 = 180.

· If @NLL2 is NULL then @NLL2 = 180.

· If @DFC1 is NULL then @DFC1 = 0.

· If @DFC2 is NULL then @DFC2 = 0.

· If @NLF1 is NULL then @NLF1 = 0.

· If @NLF2 is NULL then @NLF2 = 0.

· If @Nqf is NULL then @Nqf = 0.

· If @Yield is NULL and @Price is NULL then NULL is returned.

· If @E = 0 then NULL is returned.

· If @Freq = 0 then NULL is returned.

· C = 100 * @Rate/@Freq

· Y = @Yield/@Freq

· If @Yield is NOT NULL then price is calculated from the inputs otherwise yield is calculated from the inputs.

Examples

This is a bond with an odd short first period and odd short last period.

SELECT

wct.OFL(

.03125, --@Rate

.02875, --@Yield

NULL, --@Price

100, --@RV

2, --@Frequency

87, --@A1

NULL, --@A2

11, --@DSC

181, --@E

18, --@N

'True', --@ShortFirst

'True', --@ShortLast

44, --@DLC1

NULL, --@DLC2

184, --@NLL1

NULL, --@NLL2

98, --@DFC1

NULL, --@DFC2

NULL, --@NLF1

NULL, --@NLF2

0 --@Nqf

) as PRICE

This produces the following result.

PRICE

----------------------

102.00036224598

This is a bond with an odd long first coupon and an odd long last coupon.

SELECT

wct.OFL(

.03125, --@Rate

.02875, --@Yield

NULL, --@Price

100, --@RV

2, --@Frequency

100, --@A1

170, --@A2

11, --@DSC

181, --@E

18, --@N

'False', --@ShortFirst

'False', --@ShortLast

184, --@DLC1

74, --@DLC2

184, --@NLL1

181, --@NLL2

100, --@DFC1

181, --@DFC2

184, --@NLF1

181, --@NLF2

) as PRICE

This produces the following result.

PRICE

----------------------

102.103433425767

This is a bond with an odd long first coupon and an odd short last coupon.

SELECT

wct.OFL(

.03125, --@Rate

NULL, --@Yield

101.999004756314, --@Price

100, --@RV

2, --@Frequency

100, --@A1

170, --@A2

11, --@DSC

181, --@E

18, --@N

'False', --@ShortFirst

'True', --@ShortLast

44, --@DLC1

NULL, --@DLC2

184, --@NLL1

NULL, --@NLL2

100, --@DFC1

181, --@DFC2

184, --@NLF1

181, --@NLF2

) as YIELD

This produces the following result.

YIELD

----------------------

0.0287500000072949

This is a bond with an odd short first coupon and an odd long last coupon.

SELECT

wct.OFL(

.03125, --@Rate

NULL, --@Yield

102.104790915433, --@Price

100, --@RV

2, --@Frequency

87, --@A1

NULL, --@A2

11, --@DSC

181, --@E

18, --@N

'True', --@ShortFirst

'False', --@ShortLast

184, --@DLC1

74, --@DLC2

184, --@NLL1

181, --@NLL2

98, --@DFC1

NULL, --@DFC2

NULL, --@NLF1

NULL, --@NLF2

0 --@Nqf

) as YIELD

This produces the following result.

YIELD

----------------------

0.0287500000109004

See Also